Cloud Security

1. what is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for secure transactions. Unlike traditional currencies (like INR or USD), cryptocurrencies are decentralized and typically operate on blockchain technology—a distributed ledger that records all transactions across a network of computers. This decentralized nature means cryptocurrencies are not controlled by any central authority, such as a government or bank. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Cryptocurrencies function through peer-to-peer (P2P) networks, allowing users to send and receive payments directly without intermediaries. Transactions are verified by network participants (miners or validators) through processes like Proof of Work (PoW) or Proof of Stake (PoS). Each transaction is encrypted and added to a block, which, when completed, joins the blockchain. This process ensures transparency, security, and immutability, meaning once a transaction is recorded, it cannot be altered

Cryptocurrencies are used for various purposes, including online purchases, investment, and international transfers. They offer benefits such as lower transaction fees, faster cross-border payments, and financial inclusion for those without access to traditional banking. However, challenges include price volatility, regulatory uncertainty, and the risk of cyberattacks. Despite these challenges, cryptocurrencies continue to evolve, with increasing adoption in finance, supply chains, and decentralized applications (DApps).

2. Bitcoin

Bitcoin is the first and most well-known cryptocurrency, created in 2008 by an anonymous person or group using the pseudonym Satoshi Nakamoto. It is a decentralized digital currency that operates without a central authority, like a bank or government. Bitcoin transactions are recorded on a blockchain, a public ledger that ensures transparency and security. Users can send and receive Bitcoin through peer-to-peer (P2P) networks, allowing direct transfers without intermediaries. It is often called digital gold due to its limited supply of 21 million coins, which prevents inflation.

Bitcoin uses a process called mining to verify transactions and add new blocks to the blockchain. Miners solve complex mathematical puzzles using computational power in a system known as Proof of Work (PoW). Successful miners are rewarded with new bitcoins, which also serves as an incentive to maintain the network. This system ensures the integrity and security of transactions, making it nearly impossible to alter or hack the blockchain. Bitcoin transactions are pseudonymous, meaning they are recorded publicly but not directly linked to users' identities.

Bitcoin is used for digital payments, investment, and value storage. Many people view it as a hedge against inflation and economic uncertainty. It can be exchanged for goods, services, or other currencies through cryptocurrency exchanges. Despite its advantages, Bitcoin faces challenges like price volatility, regulatory concerns, and scalability issues. Nevertheless, it remains the largest and most valuable cryptocurrency by market capitalization, influencing the development of the entire crypto ecosystem.

3. Ethereum

Ethereum is a decentralized, open-source blockchain platform introduced in 2015 by Vitalik Buterin. It goes beyond just being a cryptocurrency by enabling the creation of smart contracts—self-executing agreements with predefined conditions. These contracts run automatically on the Ethereum blockchain without the need for intermediaries, allowing for trustless and transparent digital transactions. The platform’s native cryptocurrency, Ether (ETH), is used to pay for transactions and computational services on the network.

One of Ethereum’s key innovations is its ability to support Decentralized Applications (DApps). Developers use the Ethereum Virtual Machine (EVM) to execute code globally, making it possible to build applications like decentralized finance (DeFi) platforms, NFT marketplaces, and gaming ecosystems. This flexibility has made Ethereum the foundation for much of the blockchain industry’s innovation. Users interact with these DApps using Ether, which powers operations such as token transfers, smart contract execution, and other on-chain activities.

Ethereum is transitioning from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) model through Ethereum 2.0. This upgrade aims to improve scalability, security, and energy efficiency. By allowing users to stake their Ether to validate transactions, the network reduces its carbon footprint while increasing transaction speed. Ethereum’s influence on blockchain technology is profound, with its ecosystem driving the development of Web3, tokenization, and decentralized governance, shaping the future of digital finance and beyond.

4.Smart Contracts

Smart Contracts are self-executing digital agreements where the terms and conditions are directly written in code. These contracts run on blockchain networks like Ethereum, ensuring that once the conditions are met, the contract executes automatically without the need for intermediaries. This automation reduces human errors, increases efficiency, and provides trustless and transparent execution. For example, a smart contract can be used to automatically release payment when goods are delivered, eliminating the need for third-party verification.

One of the key features of smart contracts is their immutability—once deployed on the blockchain, they cannot be altered. This ensures that the contract’s logic is tamper-proof and the outcomes are predictable. They are used in various applications like decentralized finance (DeFi) for lending and borrowing, supply chain management for tracking goods, and NFTs for verifying ownership of digital assets. Smart contracts also support complex operations like multi-party agreements, making them suitable for advanced decentralized applications (DApps).

Smart contracts improve security by reducing the risk of manipulation and efficiency by eliminating manual processes. However, their code must be written carefully because bugs or vulnerabilities in the contract can lead to financial losses. Popular blockchain platforms supporting smart contracts include Ethereum, Binance Smart Chain, and Solana. As blockchain technology evolves, smart contracts are expected to play a critical role in automating and securing various industries, including finance, real estate, and legal systems.

5.Stablecoins

Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset like fiat currency (e.g., USD, EUR), commodities (e.g., gold), or other cryptocurrencies. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which can be highly volatile, stablecoins offer price stability, making them suitable for everyday transactions, remittances, and store of value. For example, USDT (Tether) and USDC (USD Coin) are pegged to the US Dollar, ensuring their value remains around $1.

There are three main types of stablecoins: Fiat-collateralized, Crypto-collateralized, and Algorithmic. Fiat-collateralized stablecoins are backed by real-world reserves stored by a central authority, such as a bank. Crypto-collateralized stablecoins use other cryptocurrencies as collateral and maintain their peg through over-collateralization and smart contracts. Algorithmic stablecoins rely on supply and demand algorithms to stabilize their value without physical collateral. Each type has its own advantages and risks, with fiat-backed being the most stable and algorithmic being the most experimental.

Stablecoins are widely used in the cryptocurrency ecosystem for trading, lending, and as a bridge between traditional finance and blockchain-based systems. They offer the benefits of blockchain technology, such as fast transactions and global reach, while reducing the risk of price volatility. However, stablecoins also face challenges like regulatory scrutiny, transparency concerns, and the need for regular audits to verify their reserves. As the demand for digital currencies grows, stablecoins are expected to play a significant role in digital payments, cross-border transfers, and decentralized finance (DeFi).

6.DeFi (Decentralized Finance)

DeFi (Decentralized Finance) refers to a financial system built on blockchain technology that operates without traditional intermediaries like banks, brokers, or centralized institutions. It uses smart contracts on blockchains (mainly Ethereum) to provide services such as lending, borrowing, trading, yield farming, and insurance in a permissionless and transparent way. Unlike conventional finance, DeFi allows anyone with an internet connection to access financial services, increasing financial inclusion worldwide. Popular DeFi platforms include Uniswap (decentralized exchange), Aave (lending/borrowing), and Compound (interest-earning protocols).

A key feature of DeFi is interoperability, where different protocols can work together, allowing users to move assets across multiple platforms seamlessly. For example, users can lend their cryptocurrency on one platform to earn interest and use those earnings to trade or invest on another. DeFi platforms rely on liquidity pools, where users deposit funds to enable others to trade while earning a share of the transaction fees. This peer-to-peer structure reduces costs and increases access to financial products, but it also exposes users to risks such as smart contract vulnerabilities and market volatility.

DeFi is transforming the financial landscape by offering borderless, censorship-resistant, and transparent financial systems. It enables users to maintain full custody of their assets, unlike traditional systems where banks control funds. However, challenges remain, including scalability issues, regulatory uncertainty, and security risks. As the DeFi ecosystem grows, it is expected to reshape global finance, offering alternatives to conventional banking while promoting financial democracy and innovation.

.jpg)

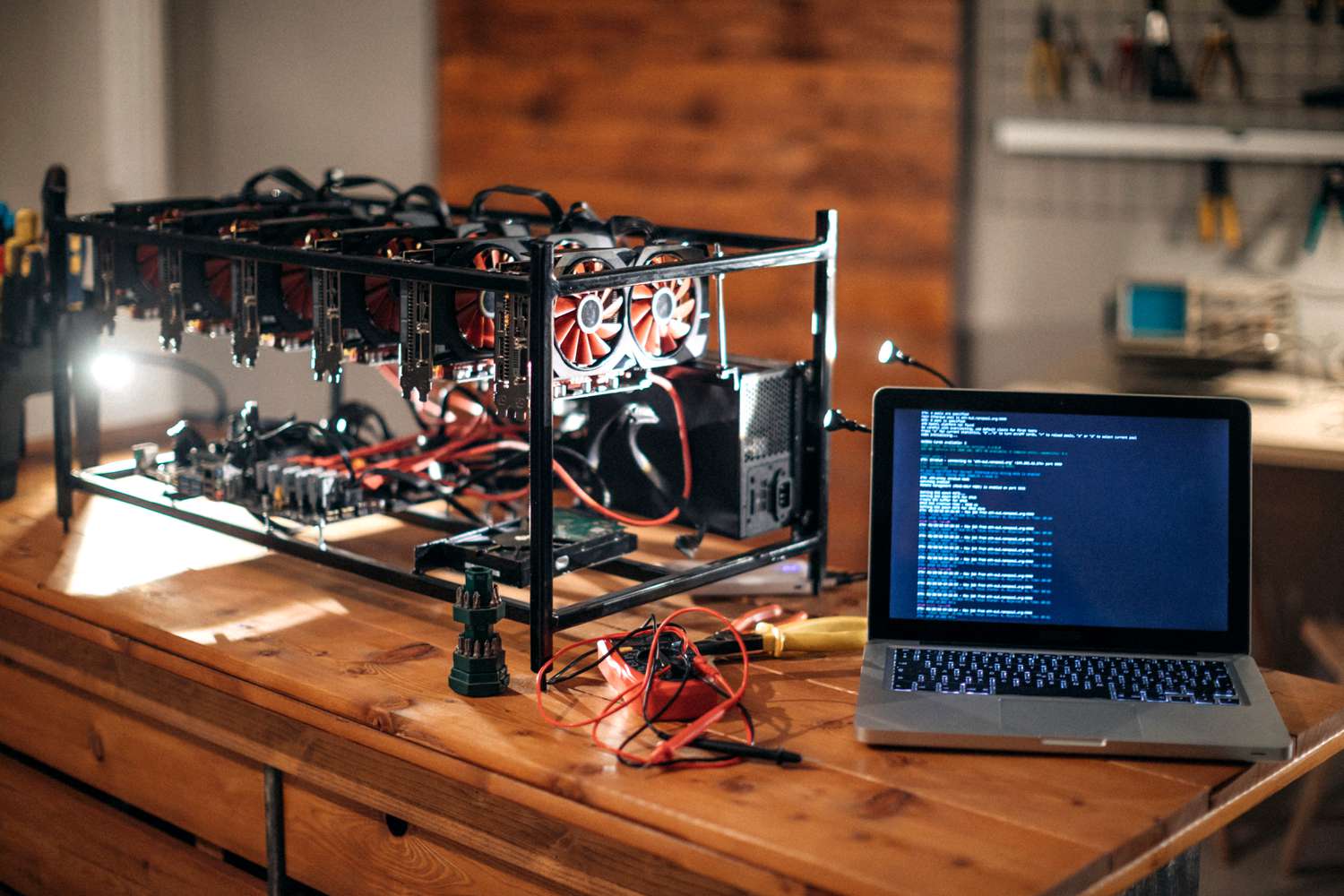

7. Crypto Mining

Crypto Mining is the process of validating and adding new transactions to a blockchain network while generating new units of cryptocurrency as a reward. It is essential for proof-of-work (PoW) based cryptocurrencies like Bitcoin and Ethereum (before its shift to proof-of-stake). Miners use specialized hardware to solve complex mathematical puzzles, and the first miner to solve the puzzle adds a new block to the blockchain. In return, they receive a block reward in the form of newly minted cryptocurrency and transaction fees. This process ensures the network remains secure, decentralized, and transparent by verifying all transactions.

The mining process involves three main steps: first, miners gather and validate transactions to form a block. Next, they compete to find a cryptographic hash—a unique code—by repeatedly guessing values through brute force calculations. Once a miner successfully finds the correct hash, the new block is added to the blockchain, and the miner earns a reward. Mining requires powerful hardware like ASICs (Application-Specific Integrated Circuits) for Bitcoin and GPUs (Graphics Processing Units) for other cryptocurrencies. It is a resource-intensive activity, consuming large amounts of electricity, which raises concerns about energy consumption and environmental impact.

There are different types of mining methods, including solo mining, pool mining, and cloud mining. Solo mining involves an individual miner working independently, which requires high computing power and offers higher rewards but is difficult to achieve. Pool mining allows miners to combine their computational resources to solve puzzles faster and share the rewards proportionally. Cloud mining involves renting mining power from a remote data center, allowing individuals to mine without owning the hardware. Despite challenges like rising electricity costs and increased competition, crypto mining remains a crucial part of maintaining blockchain networks and generating new cryptocurrencies.

8. NFT Marketplaces

NFT Marketplaces are online platforms where users can buy, sell, and trade Non-Fungible Tokens (NFTs). NFTs represent unique digital assets like art, music, videos, collectibles, and virtual real estate. These marketplaces operate on blockchain technology, ensuring transparency, security, and ownership verification. Users need a cryptocurrency wallet to interact with these platforms, typically using cryptocurrencies like Ethereum (ETH). Popular NFT marketplaces include OpenSea, Rarible, Foundation, and Magic Eden. Each marketplace may focus on specific categories such as digital art, gaming assets, or virtual goods, offering creators and collectors a space to monetize and exchange digital property.

Most NFT marketplaces work through smart contracts, which automate ownership transfers and royalty payments to creators. Artists can mint (create) their NFTs, list them for auction or fixed-price sales, and receive royalties each time the NFT is resold. Buyers can explore collections, place bids, and securely store their NFTs in digital wallets. Marketplaces also offer verification processes to ensure the authenticity of high-value or celebrity-backed NFTs. Transactions on these platforms are public and immutable, meaning they cannot be altered once recorded on the blockchain.

NFT marketplaces continue to evolve, offering cross-chain compatibility, fractional NFT ownership, and gas-free minting to make NFTs more accessible. Innovations like NFT staking, rental markets, and metaverse integrations further expand use cases. Despite market volatility and regulatory concerns, NFT marketplaces drive a global digital economy, enabling artists and investors to monetize creativity and engage in a decentralized and borderless digital ecosystem.

Comments